My review of Gillian Tett’s book has appeared in the Times Literary Supplement.

My review of Gillian Tett’s book has appeared in the Times Literary Supplement.

This review, of Layard and Clark’s Thrive and William Davis’s The Happiness Industry, has appeared in the Times Literary Supplement.

This paper, joint with Alice Mesnard, is forthcoming in the Journal of Demographic Economics, and the uncorrected proof is available here.

Abstract:

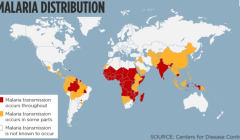

This paper models how migration both influences and responds to differences in disease prevalence between cities and shows how the possibility of migration away from high-prevalence areas affects long-run steady state disease prevalence. We develop a dynamic framework where migration responds to the prevalence of disease, to the costs of migration and to the costs of living. The model explores how pressure for migration in response to differing equilibrium levels of disease prevalence generates differences in city characteristics such as land rents. Competition for scarce housing in low-prevalence areas can create segregation, with disease concentrated in high-prevalence “sinks”. We show that policies affecting migration costs affect the steady-state disease prevalence across cities. In particular, migration can reduce steady-state disease incidence in low-prevalence areas while having no impact on prevalence in high-prevalence areas. This suggests that, in some circumstances, public health measures may need to avoid discouraging migration away from high-disease areas.

This article (joint with Pierre Dubois, Olivier de Mouzon and Fiona Scott Morton), has now appeared in the Rand Journal of Economics, and is available under Open Access.

Abstract:

This article quantifies the relationship between market size and innovation in the pharmaceutical industry using improved, and newer, methods and data. We find significant elasticities of innovation to expected market size with a point estimate under our preferred specification of 0.23. This suggests that, on average, $2.5 billion is required in additional revenue to support the invention of one new chemical entity. This magnitude is plausible given recent accounting estimates of the cost of innovation of $800 million to $1 billion per drug, and marginal costs of manufacture and distribution near 50%.

This article, joint with Samuele Centorrino, Elodie Djemai, Astrid Hopfensitz and Manfred Milinski, has now appeared in Adaptive Human Behavior and Physiology, and is available under Open Access.

Abstract:

We develop a theoretical model under which “genuine” or “convincing” smiling is a costly signal that has evolved to induce cooperation in situations requiring mutual trust. Prior to a trust interaction involving a decision by a sender to send money to a recipient, the recipient can emit a signal to induce the sender to trust them. The signal takes the form of a smile that may be perceived as more or less convincing, and that can be made more convincing with the investment of greater effort. Individuals differ in their degree of altruism and in their tendency to display reciprocity. The model generates three testable predictions. First, the perceived quality of the recipient’s smile is increasing in the size of the stake. Secondly, the amount sent by the sender is increasing in the perceived quality of the recipient’s smile. Thirdly, the expected gain to senders from sending money to the recipient is increasing in the perceived quality of the recipient’s smile.

This article, joint with Guido Friebel and Jibirila Leinyuy, has appeared in World Development, April 2015 (pages 124-135) and is available here.

Abstract:

We show that in family or household firms, credit constraints can make business investment a direct competitor to educational investment. We test this theory on data collected in Cameroon. Households that are not restricted by credit constraints invest more in education when demand for the product they produce and sell increases. However, credit-constrained households react in the opposite way: when demand increases, they invest less in education, as predicted by our theory. We obtain these results controlling for endogeneity of family size, of demand conditions, and credit constraints.

The title of the paper has the following origin. The composer’s father, Franz Theodor Schubert, ran a school which he had taken over and reformed to make it more attractive to middle-class parents. Franz Theodor obliged his son to work in the school as a teacher for some years rather than to try his luck as a professional musician. To what extent this was because the father could not afford to invest in his son’s musical career (the hypothesis of our paper) or because he could not find a good substitute for his son’s teaching skills on the open market we are not in a position to say. Suffice it to say that the composer eventually broke free of this constraint and went on to work as a musician and composer, including as the teacher of Count Esterhazy. The rest of the story, as they say, is history – but we would like to claim that it is also economics.